Click on image for full screen view.

Kenote Presentation at AlgaEurope 2023 • by robert Henrikson

December 15, 2023 in Prague, Czech Republic.

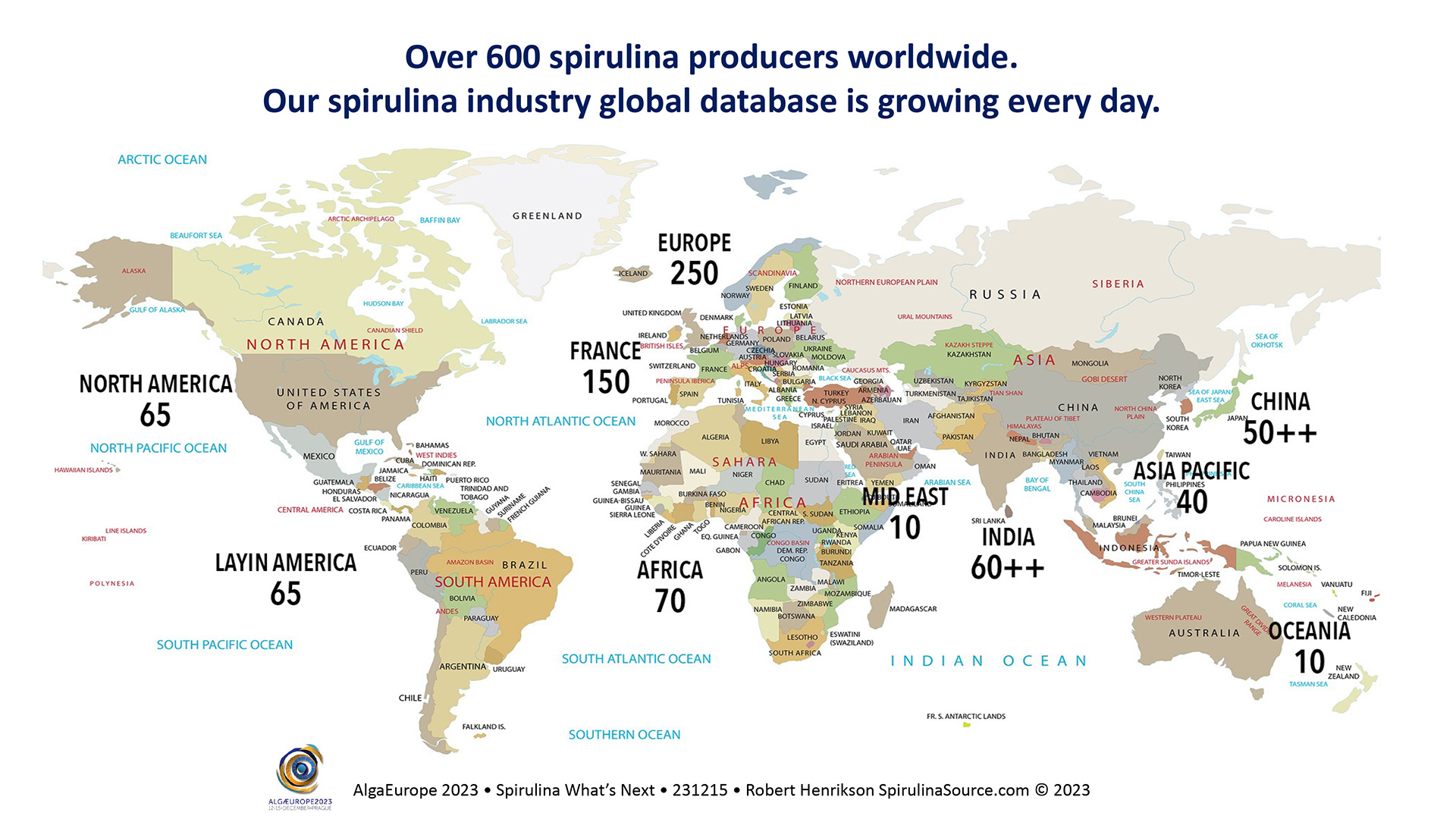

Over 600 spirulina producers worldwide and growing. What’s next?

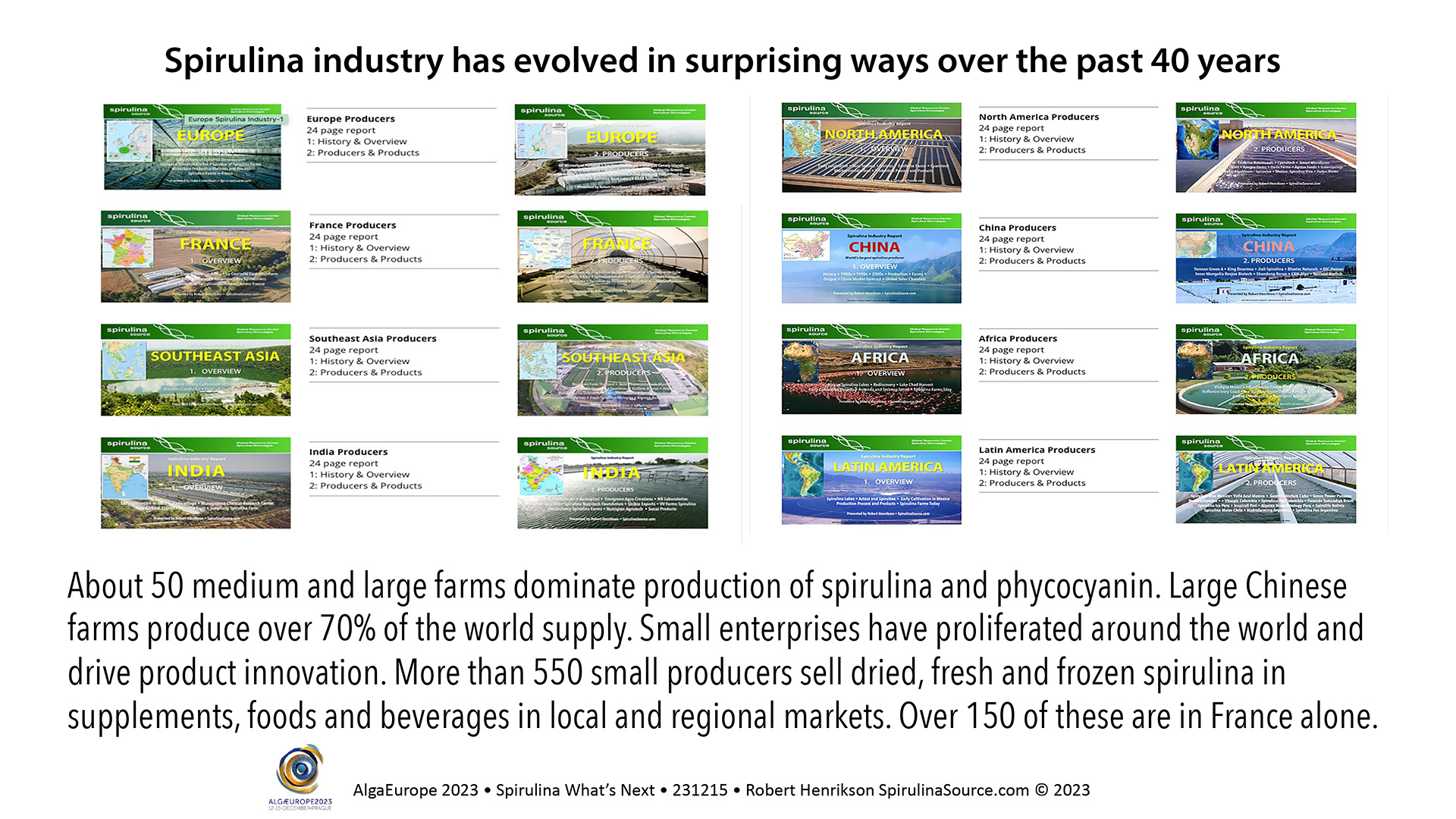

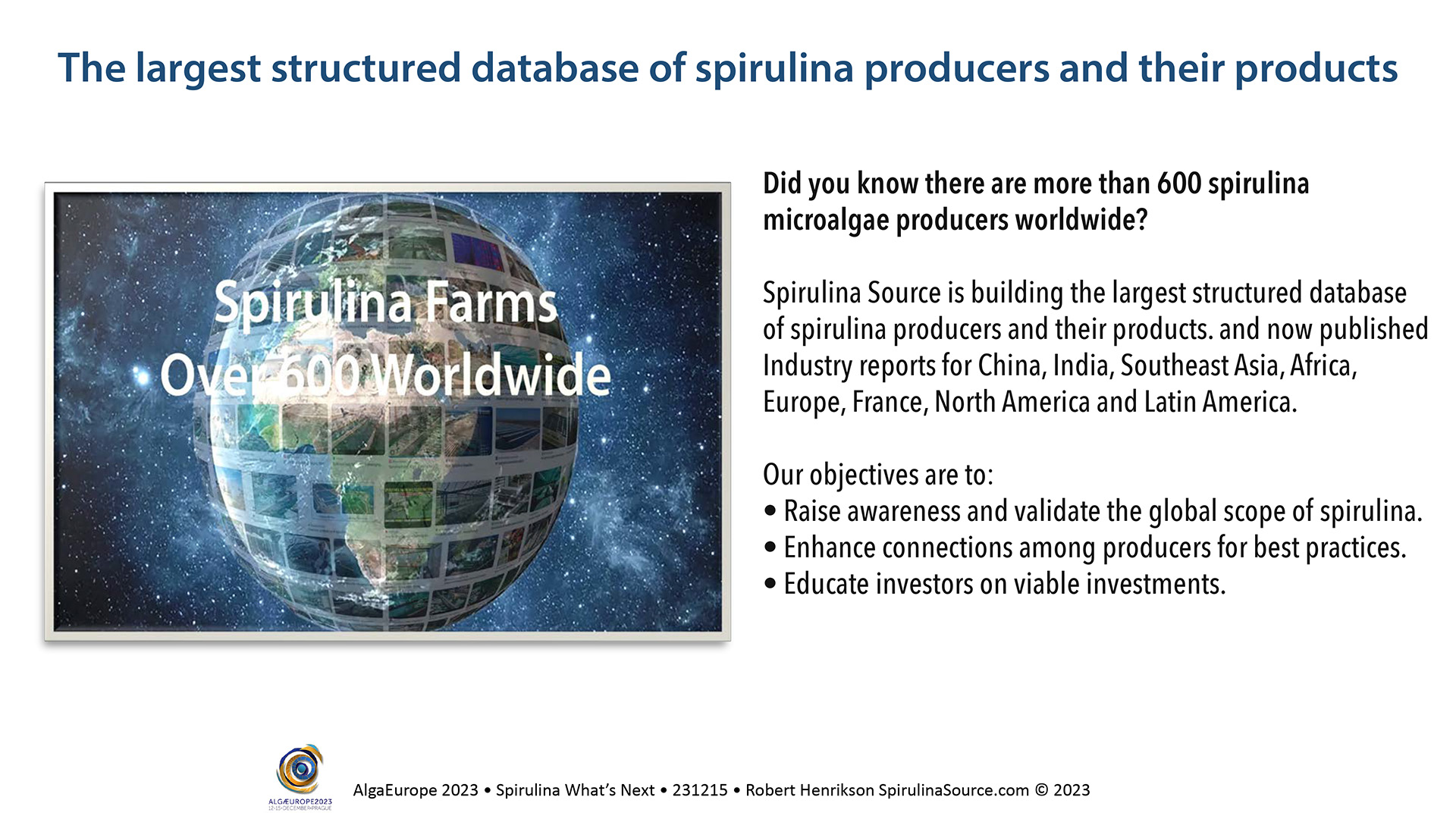

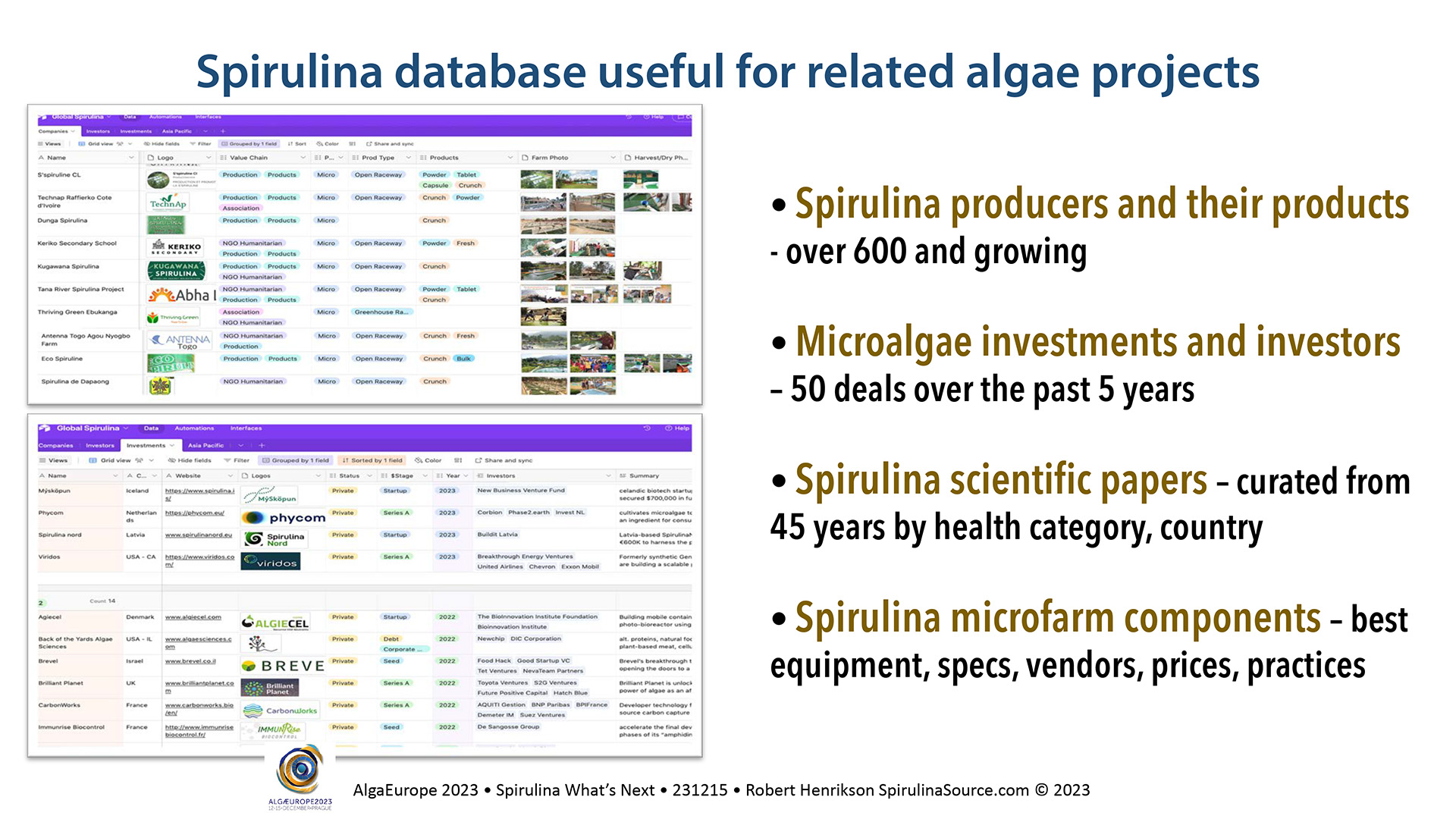

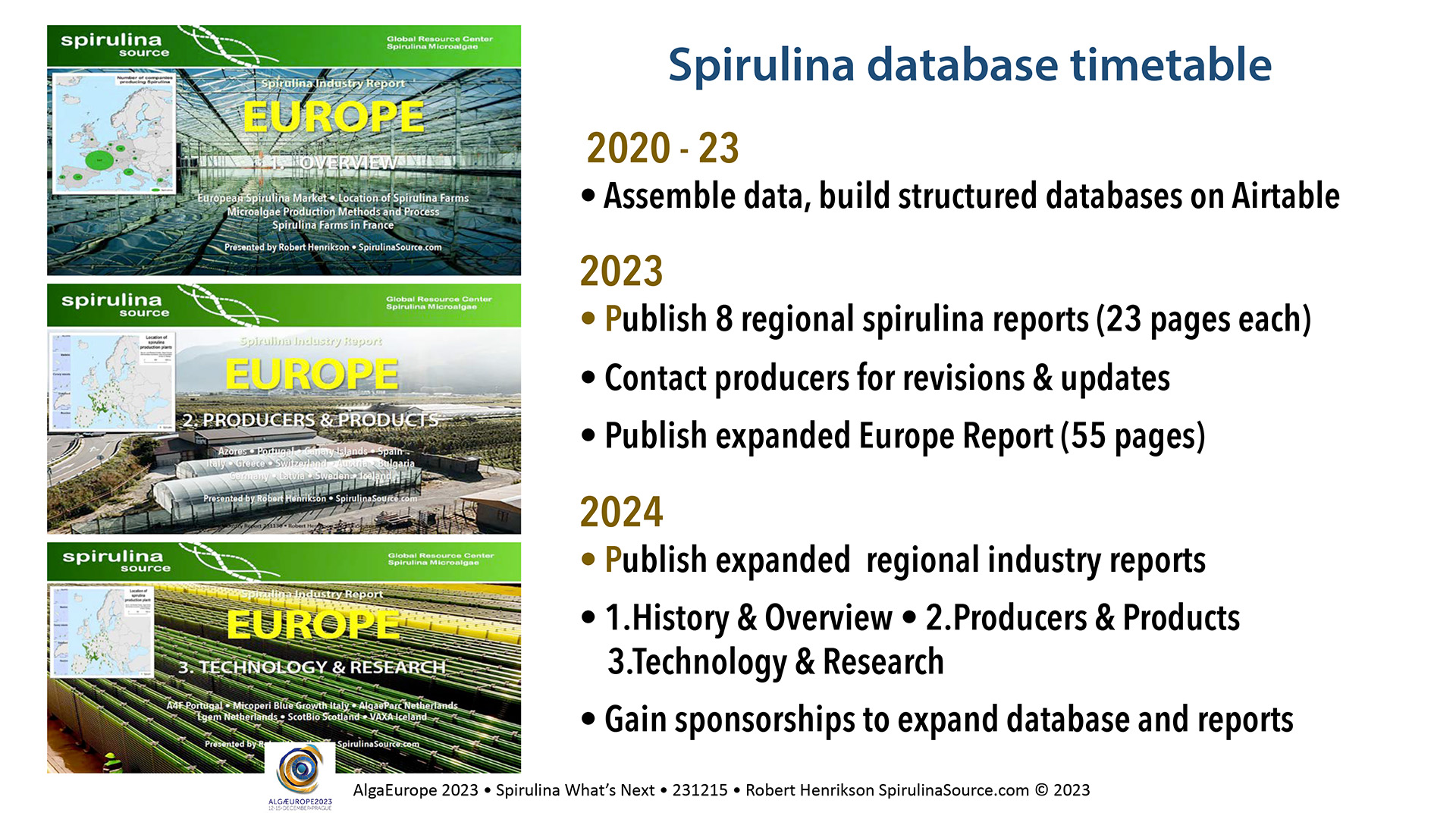

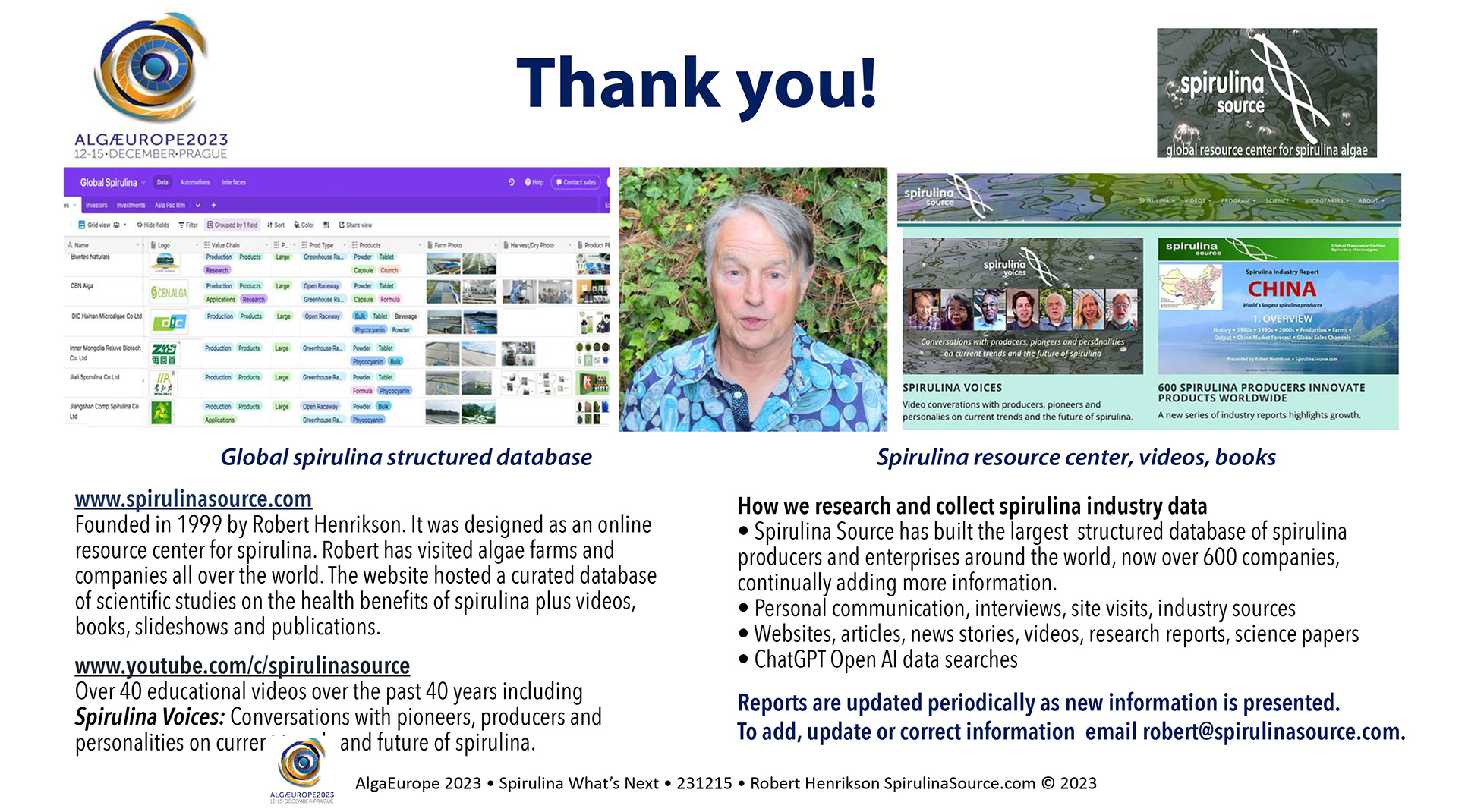

Spirulina source has built the largest structured database of spirulina producers and their products and released a free series of 8 Producer Reports for China, India, Southeast Asia, Africa, Europe France, North America and Latin America. www.spirulinasource.com/spirulina-reports/.

Goals are to raise awareness of the global scope of spirulina, enhance connections among producers, educate investors on viable investments.

The global spirulina market has evolved in surprising ways over the past 40 years. About 50 medium and large farms produce spirulina powder and phycocyanin, but large Chinese farms dominate the global market and produce over 70% of the world supply.

Meanwhile, small enterprises proliferate around the world and drive product innovation. More than 550 small producers sell fresh, frozen and dried spirulina in supplements, foods, beverages and value-added products in local and regional markets. Over 150 are in France alone.

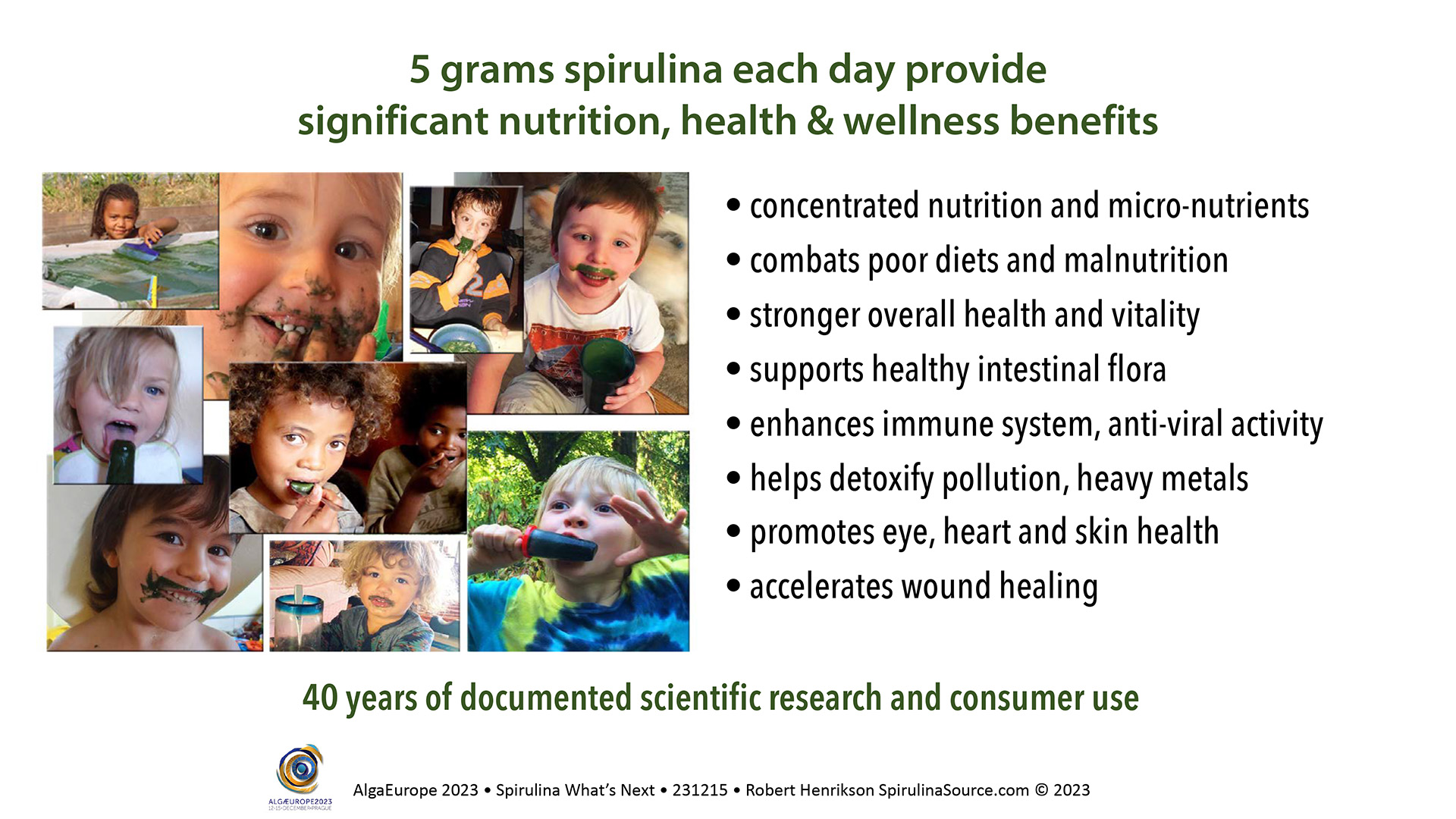

Once promoted as ‘food of the future’, more spirulina is produced worldwide than any other microalgae. Thousands of scientific reports support its health benefits. Consumed by millions of people and widely available. But still expensive.

All other commercial microalgae have smaller markets and are even more costly to produce.

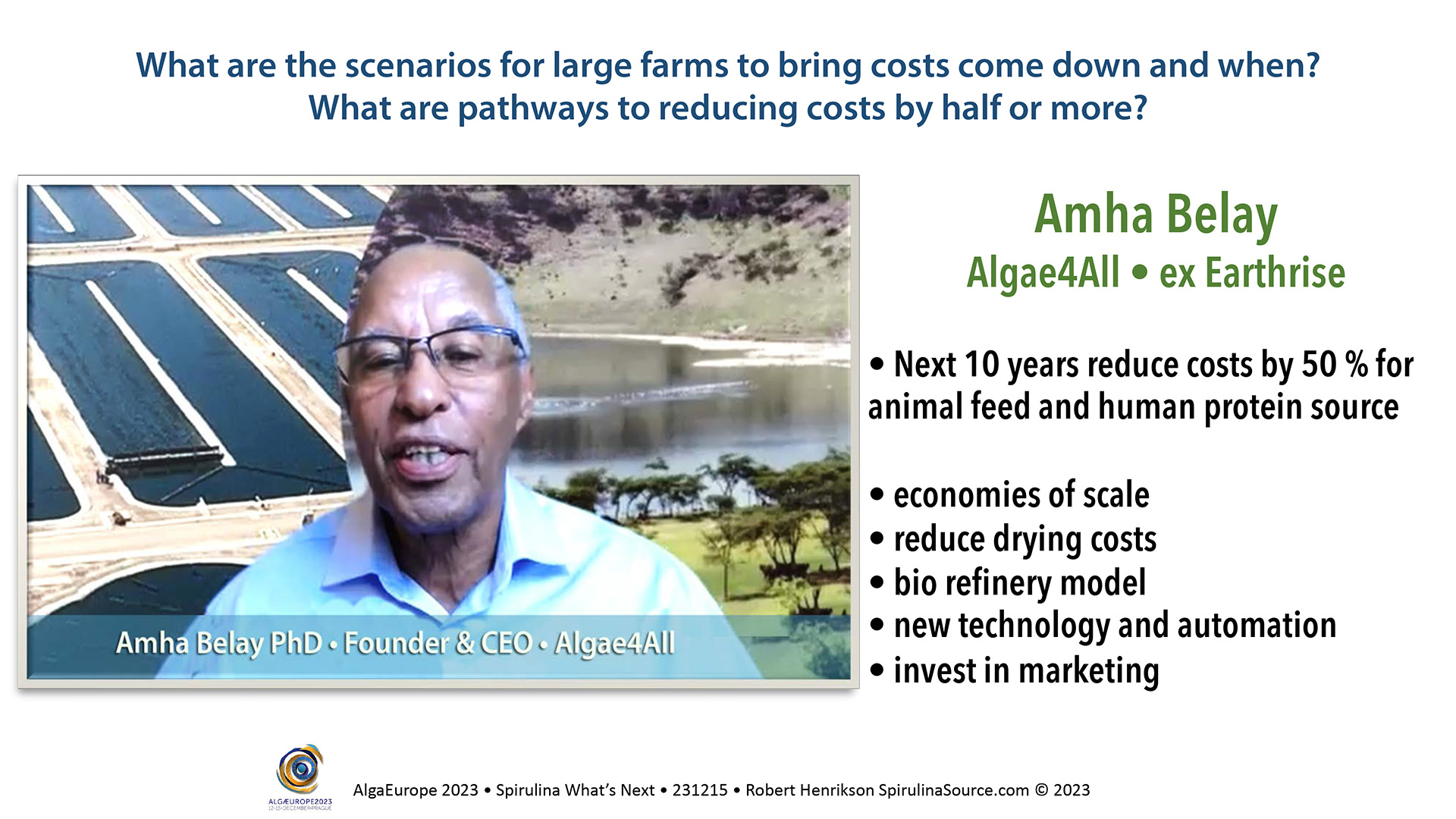

Over the past 40 years, production costs have remained high. The global supply chain adds layers of costs to deliver products to consumers. Market prices are too high for spirulina to be an alternative to conventional protein.

Will spirulina (and other microalgae) remain in niche markets – nutraceutical supplements, colorants and biomedical applications? How does this future unfold?

What are the scenarios for large commercial farms to bring costs come down and when? What are pathways to reducing costs by half or more?

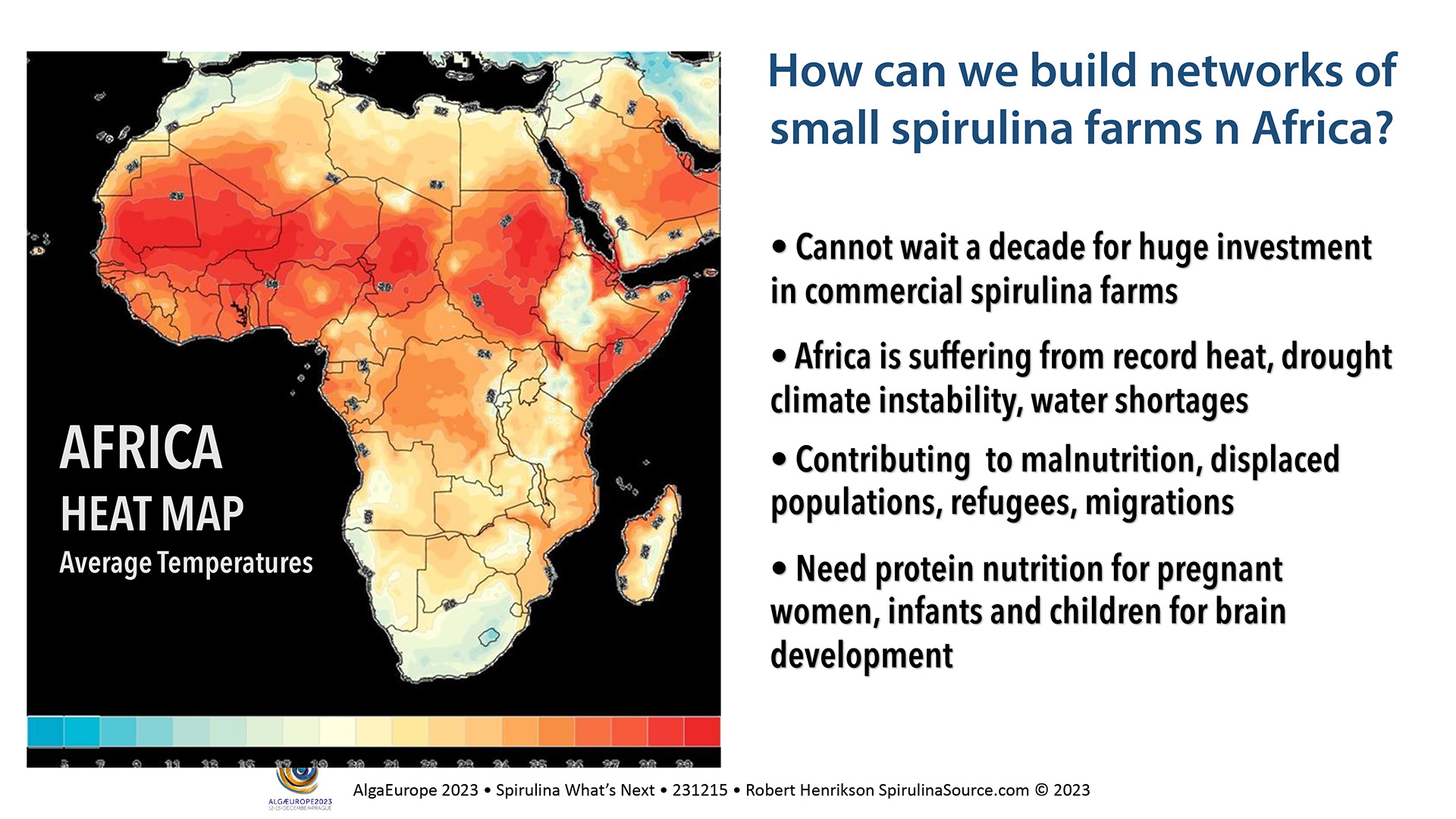

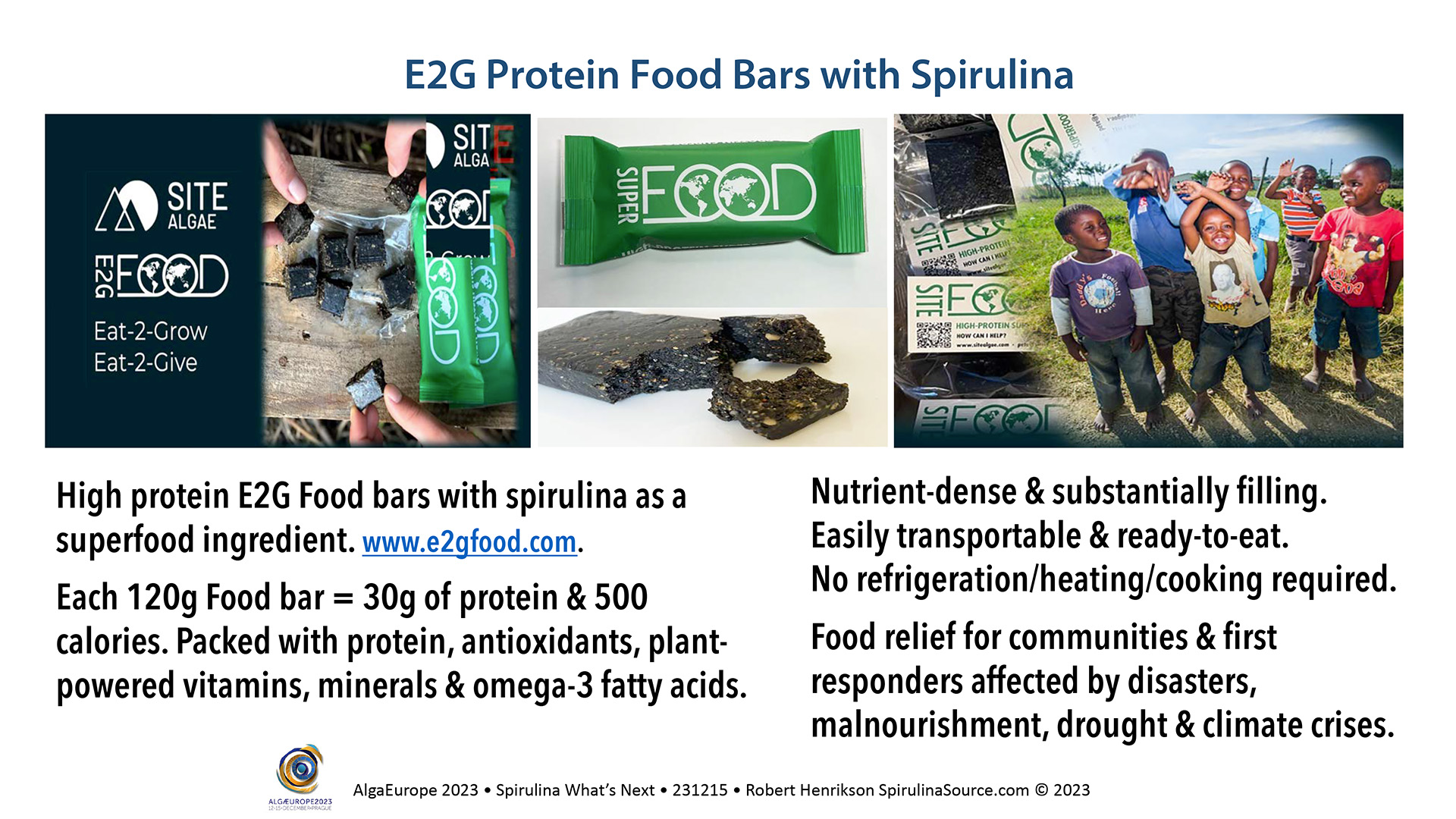

What are the scenarios for spirulina to become a protein food to combat malnutrition for millions of mothers and infants?

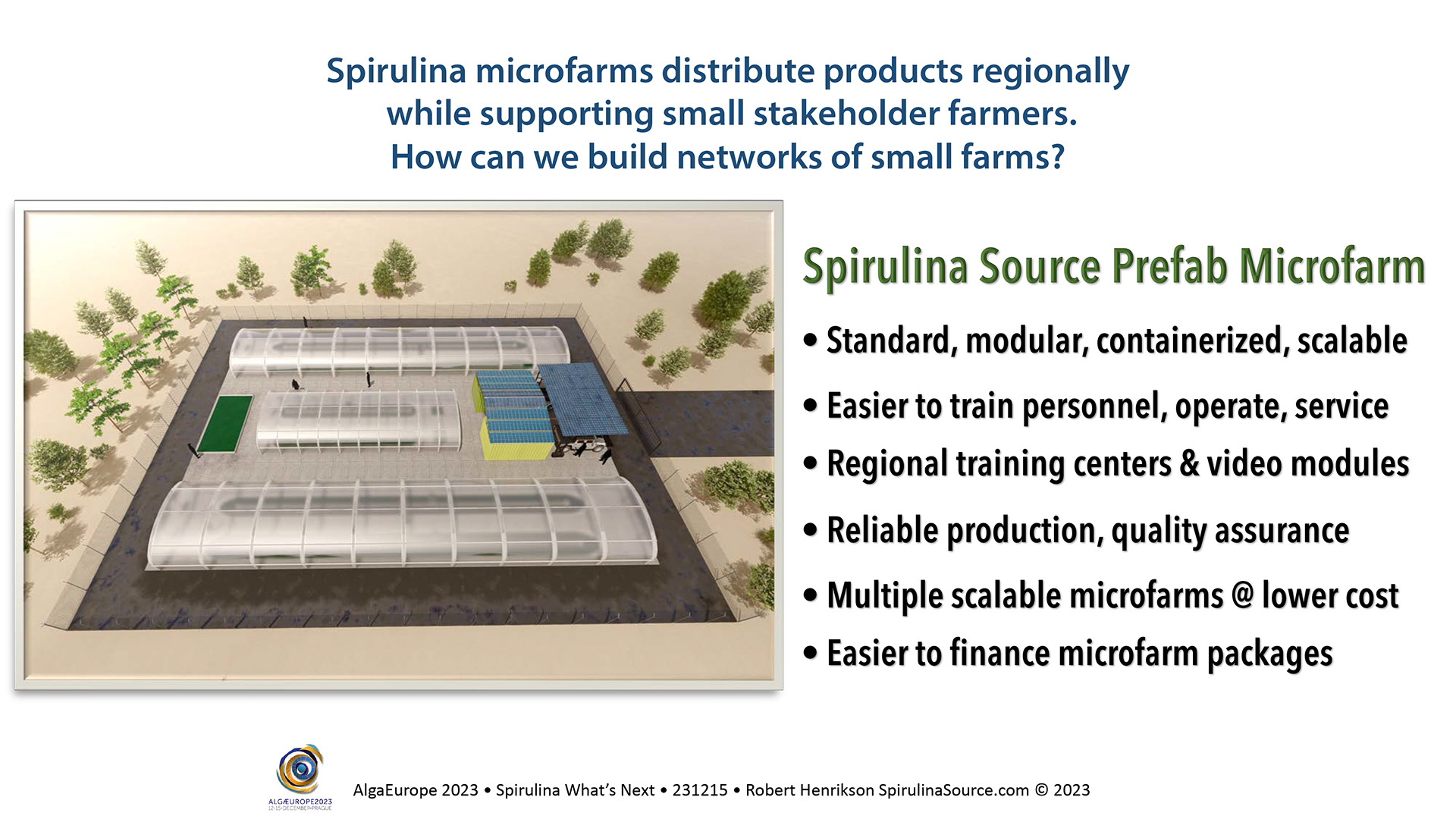

Mmicrofarms distribute products regionally while supporting small stakeholder farmers. What are the scenarios for building networks of small farms and how?